Actual and Potential Growth

H2 TYS 2014

4a) Explain the key determinants of actual and potential economic growth. [10]

Note by Lighthouse Economics Tutors:

Hi everyone! This is actually an easy question but there are a few common misconceptions to look out for~

❌ Actual growth only comes from AD

Actual economic growth refers to an increase in real national output over time (from Y0 to Y1). Actual growth can be caused by an increase in AD or SRAS, not just AD. Students often focus on AD because in exams, due to time constraints, actual growth is usually illustrated using AD. However, SRAS can also drive actual growth, and this has come out in CSQs before where students failed to identify the correct factor 😬❌ AD components are determinants

When the question asks for determinants or factors of AD or actual growth, you cannot say the factor is an increase in consumption (C) or investment (I). These are components of AD, not determinants. You must explain the underlying factor, for example an increase in national income leading to higher purchasing power and hence higher C (a component of AD). The determinant here is income, NOT C 💡

Introduction

Economic growth can be categorized into actual and potential growth. Actual growth reflects the realized increase in real Gross Domestic Product (GDP) over time, driven primarily by changes in Aggregate Demand (AD) or the increase in Short-Run Aggregate Supply (SRAS). Conversely, potential growth represents an expansion in the economy’s productive capacity, depicted by a rightward shift in the Long-Run Aggregate Supply (LRAS) curve. Understanding the key determinants of these two types of growth is crucial for effective economic policymaking.

R1: Determinants of Actual Economic Growth(AD and SRAS)

Actual economic growth can be a result of an increase in components of Aggregate Demand (AD) including Consumer Spending (C), Investment (I), Government Spending (G), and Net Exports (X - M).

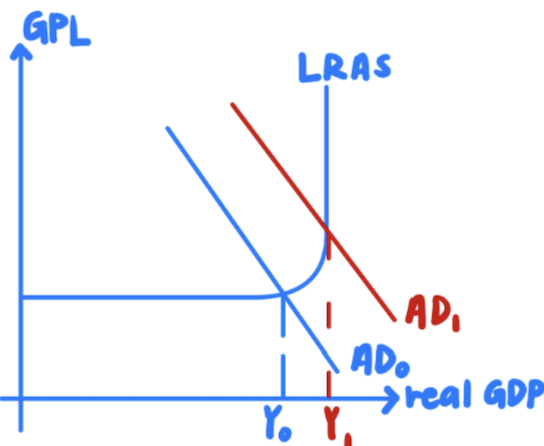

One of the most significant determinants of actual economic growth is consumer and business confidence. When there is an optimistic economic outlook during an economic boom, consumers are more inclined to spend, and firms are more likely to invest in new projects, directly boosting consumption (C) and investment (I) and hence Aggregate Demand (AD). For instance, after the Global Financial Crisis of 2008-2009, Singapore's economy rebounded strongly leading to a surge in consumer and investor confidence. The government's Resilience Package also restored confidence, leading to increased consumer spending and business investment. As a result, AD increases from AD0 to AD1, leading to an increase in Real National Output (NY) from NY0 to NY1, resulting in actual economic growth (figure 1).

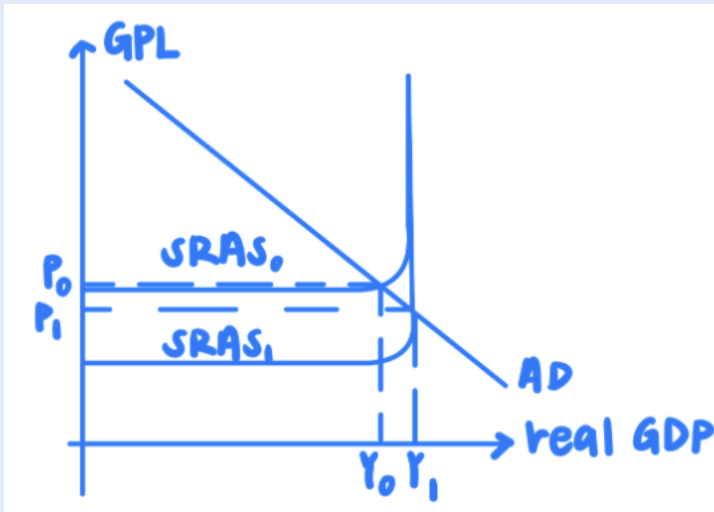

<Optional in the absence of time> In addition to demand-side factors, Short-Run Aggregate Supply (SRAS) also plays a crucial role in driving actual growth. SRAS can shift to the right due to factors such as lower production costs, improved productivity, or favorable supply-side policies. For example, a decrease in global oil prices reduces production costs across various industries, allowing firms to produce more at the same price level. Similarly, advancements in technology can enhance productivity, enabling higher output with the same level of inputs increasing the unit cost of production. As seen in figure 2, an increase in SRAS from SRAS0 to SRAS1, will lead to an increased economy's output from Y0 to Y1, contributing to actual growth. In Singapore, the adoption of advanced manufacturing technologies and efficient supply chain management has frequently led to such shifts in SRAS, enhancing the country's economic output.

R2: Determinants of Potential Economic Growth

Potential economic growth is driven by factors that expand the economy’s productive capacity, which is represented by a rightward shift in the Long-Run Aggregate Supply (LRAS) curve. Two key determinants of potential growth are the quantity and quality of resources available, particularly labor, and technological advancements.

The quantity and quality of labor are critical determinants of potential economic growth. An increase in the labor force, whether through population growth or higher labor force participation, increase the quantity of labour and hence productive capacity of an economy. In Singapore, where the domestic labor pool is limited, policies aimed at attracting skilled foreign workers are essential for expanding both the quantity and quality of the labor force. These skilled workers not only increase the number of available workers but also bring specialized expertise and knowledge, enhancing the overall productivity of the workforce. For example, Singapore's open immigration policies helps to increase both the quantity and quality of labour, thereby supporting potential growth by boosting the economy's productive capacity.

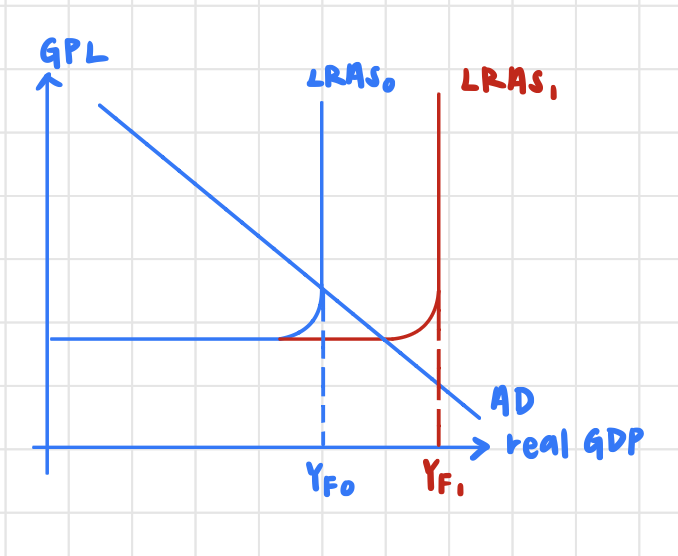

Technological advancements significantly allows the economy to produce more output with the same amount of resources hence increasing productive capacity.. Singapore's emphasis on becoming a global hub for innovation through initiatives like the Research, Innovation and Enterprise (RIE) 2025 plan highlights the importance of technology in driving potential growth. Investments in research and development (R&D), as well as the adoption of cutting-edge technologies in sectors like biotechnology and artificial intelligence, have enabled Singapore to enhance its productive capacity. These advancements shift the LRAS curve to the right from LRAS0 to LRAS, leading to an increase in the full employment level from YF0 to YF1, indicating an increase in potential growth of the economy.

Conclusion

In conclusion, actual economic growth is primarily driven by increases in Aggregate Demand (AD) and improvements in Short-Run Aggregate Supply (SRAS), while potential growth hinges on expanding the economy’s productive capacity through resource augmentation and technological advancements. Understanding these determinants is vital for policymakers to foster sustained economic growth and stability.