Types of Inflation

VJC 2024 prelims Q5

In early 2022, Sri Lankans started experiencing power cuts and shortages of basics such as fuel. The rate of inflation rose to 50 per cent while unemployment rate remains high. Currently, Sri Lanka owes about $7 billion to China and around $1 billion to India.

a) Explain two possible causes of inflation.

Introduction

Inflation refers to a sustained increase in the general price level of goods and services. It can be broadly categorized into demand-pull inflation and cost-push inflation. Demand-pull inflation occurs when aggregate demand (AD) rises faster than the economy’s productive capacity, leading to upward pressure on prices. Cost-push inflation arises from rising production costs, which force firms to increase prices. This includes wage-push inflation (higher labor costs) and imported inflation (higher costs of imported goods due to exchange rate depreciation or global supply shocks). The possible causes of inflation in Sri Lanka will be further discussed below.

R1: One Possible Cause of Demand-Pull Inflation

A key cause of demand-pull inflation in Sri Lanka is the post-COVID-19 economic recovery, which led to higher consumption (C) and investment (I). As economies reopened and pandemic-related restrictions eased, consumer confidence improved, leading to an increase in household spending on goods and services. Similarly, businesses became more optimistic about future growth and ramped up investment expenditure to expand operations. Since both consumption and investment are key components of aggregate demand (AD), their increase led to an overall rise in AD.

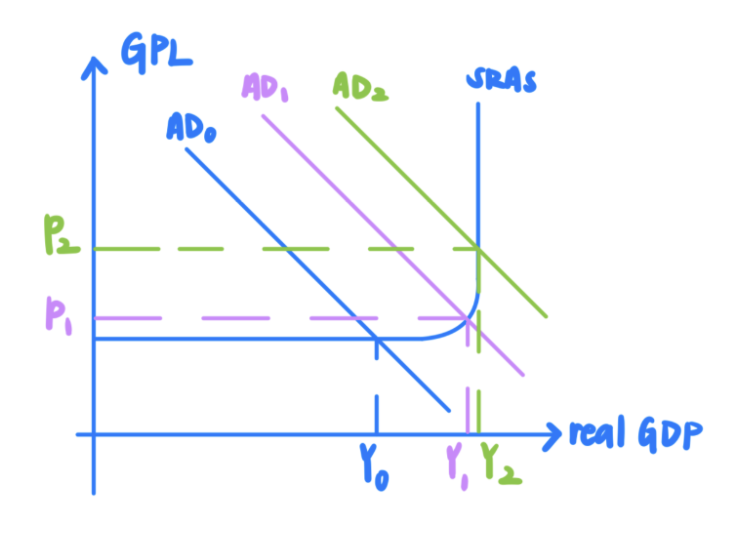

The rise in AD from AD0 to AD1 triggered multiple rounds of income-induced spending through the multiplier effect, further increasing AD to AD2. As the economy approached full employment output, resources became increasingly scarce, leading to greater competition for factors of production. This caused firms to raise wages and production costs, which were then passed on to consumers in the form of higher prices. As a result, the increase in AD from AD1 to AD2 led to a rise in the general price level from P1 to P2, causing demand-pull inflation.

R2: Cost-Push Inflation

Cost-push inflation occurs when rising production costs force firms to increase prices to maintain profit margins. Two key causes of cost-push inflation in Sri Lanka are wage-push inflation and imported inflation.

Wage-Push Inflation

Following the earlier discussion on demand-pull inflation, COVID-19 recovery has also contributed to wage-push inflation. As aggregate demand (AD) and national income increase, firms expand production, leading to a higher derived demand for labor. However, as the economy approaches full employment national income (Yf), labor becomes increasingly scarce. With rising competition for workers, firms are forced to offer higher wages, increasing production costs. To maintain profit margins, firms pass these costs onto consumers, causing wage-push inflation.

OR

Imported Inflation

Another cause of cost-push inflation is imported inflation, which arises due to supply chain disruptions. The Russia-Ukraine war led to a global surge in energy and food prices, significantly increasing import costs for firms in Sri Lanka. Since energy is a key input in transportation and production, higher oil and fuel prices raised the cost of production across multiple industries. Additionally, rising food prices increased input costs for food manufacturers.As firms face higher production costs, they reduce supply at previous price levels, leading to a leftward shift in short-run aggregate supply (SRAS) from SRAS0 to SRAS1. This contraction in SRAS causes the general price level to rise from P0 to P1, resulting in imported inflation, as firms pass on higher costs to consumers through increased prices.

Conclusion

In summary, inflation in Sri Lanka can be caused by both demand-pull and cost-push factors. Post-COVID-19 recovery led to increased consumption and investment, driving demand-pull inflation, while higher wages and rising import costs due to global supply chain disruptions contributed to cost-push inflation. As inflationary pressures persist, policymakers may need to implement monetary or fiscal measures to stabilize prices.